Exploration

KMG pursues its Development Strategy until 2031 approved in 2021. The Development Strategy provides for the strategic goal of the Resource base sufficient to support the Company’s growth that envisages exploration at seven offshore and seven onshore projects, as well as further exploration at the key existing fields. The exploration is expected to increase the Company’s recoverable ABC1 reserves by 253 mln tonnes by 2031. It is planed to keep a reserve replacement ratio of 105% through organic growth by 2031.

In the medium term, KMG will continue to ramp up its investments in exploration reaching more than USD 426 mln between 2024 and 2028. The planned exploration programme includes 2D and 3D seismic surveys of about 5,000 linear km and more than 1,300 km2, respectively.

During this period, we expect 30 exploration and appraisal wells to be drilled, including first prospecting wells at the Karaton Subsalt, Turgai Palaeozoic, Taisoigan, and Abay exploration blocks with further drilling of related appraisal wells. Also, there are plans continued further exploration and reserve replenishment at existing fields, with more than 20 appraisal wells to be drilled.

We expect to secure two contracts (Bolashak and Karazhar) and potentially four new contracts based on the results of subsoil exploration.

Exploration highlights in 2023

In 2023, an estimated USD 135 mln was invested in exploration (KMG’s share accounts for USD 52 mln, the rest came from partners as carry financing):

- 400 km2 of 3D and 1,613 linear km of 2D field seismic surveys were carried out, over 3,200 linear km and over 440 km2 of seismic data were reprocessed.

- 17 exploration and appraisal wells were drilled and tested.

- Recoverable reserves of liquid hydrocarbons are expected to increase by about 34.8 mln tonnes, including organic growth (1.9 mln tonnes), inorganic growth (33.8 mln tonnes), return of unprofitable Embamunaigas fields (Dossor, Sagiz, Tanatar) to the government (‑0.9 mln tonnes) and the completion of the evaluation period for the Urikhtau field (KT‑2 and Devon deposits), which represents 148% of the ABC1 reserve replacement ratio with an annual production of 23.5 mln tonnes.

- In January 2023, drilling of an exploration well was completed at the Zhenis offshore exploration block as part of a project implemented jointly with LUKOIL, our strategic partner. The drilling and surveys did not find any oil or gas deposits, meaning that the geological risk was realised.

- In 2023, a subsoil use contract was obtained for the Karaton Subsalt block (353 mln tonnes of geological resources (P50)) jointly with Tatneft, our strategic partner. The partner made a commitment to provide 100% of financing for the exploration phase. The subsoil use was transferred to Karaton Operating, the operator established for the project. Work continues to agree design documents for the project and the operator’s organisational arrangements. Drilling of a 5,500 m prospecting well is scheduled to begin in 2024.

- In 2023, a contract was also obtained for the Kalamkas‑Sea / Khazar block jointly with LUKOIL, a strategic partner. The subsoil use was transferred to Kalamkas‑Khazar Operating, a partnership established for the purpose. The reprocessing and reinterpretation of historical seismic data are underway.

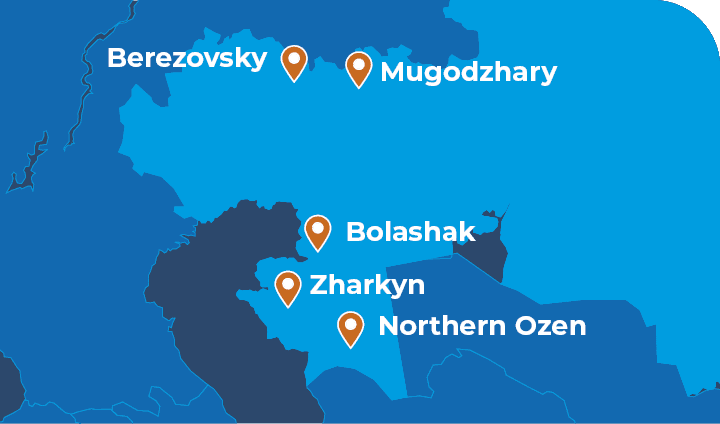

- In 2022, the analysis and modelling of main sedimentary basins identified five most prospective blocks that require further exploration (Zharkyn, Bolashak, Northern Ozen, Berezovsky, Mugodzhary). In 2023, KMG Barlau, the Company’s 100% subsidiary, completed field seismic surveying at three blocks (Zharkyn, Northern Ozen, Berezovsky), with processing and interpretation of seismic data currently underway. Field work continues at one promising block. The reprocessing and reinterpretation of historical seismic data for the single remaining block were completed, which resulted in adjustments to the plans for the upcoming field work. Following seismic data processing and interpretation as well as geological and technical evaluation, a decision will be made in 2025 whether to obtain subsoil use contracts. Work is in progress under subsoil exploration licences obtained in 2022.

Plans for 2024

In 2024, a total of about USD 191 mln is planned to be invested in exploration, with USD79 mln of the costs attributable to KMG.

What we plan for 2024:

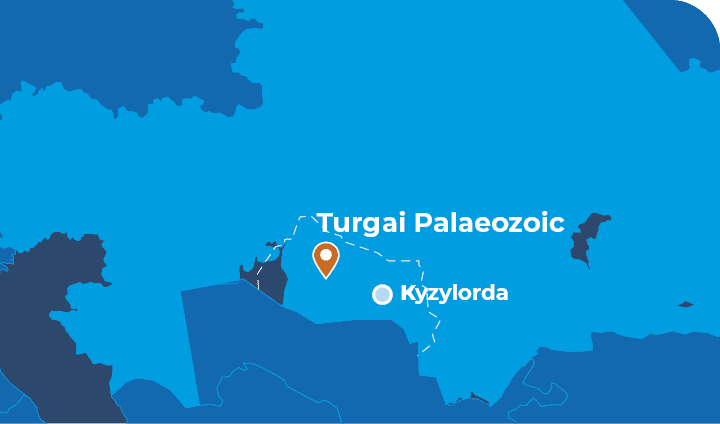

- Start drilling of the first prospecting well at the Turgai Palaeozoic block with a depth of 5,500 m at KMG's own expense. Its geological resources (P50) amount to 399 mln tonnes.

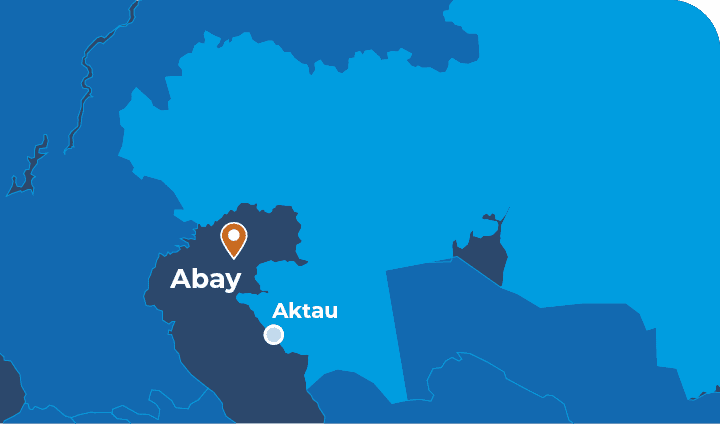

- Drill and test the first prospecting well at the Abay offshore block with a depth of 2,500 m. Financing at the exploration stage is provided by Eni, our strategic partner.

- Obtain a contract for the Karazhar exploration block. Geological resources (P50) at the block total 32 mln tonnes.

- Obtain a contract for the Bolashak exploration block jointly with a strategic partner. Geological resources (P50) at the block total 344 mln tonnes.

Also, based on the analysis of historical geological and geophysical data and basin modelling, five new promising blocks were identified for inclusion in the National Acreage Management Programme for further consideration of obtaining subsoil use contracts.

New exploration projects and cooperation in exploration

In 2023, the Company continued to strongly focus on expanding its cooperation in exploration with international oil and gas companies: To attract investments and to share risks in exploration, KMG takes active steps to team up with strategic partners. To this end, memoranda of understanding were signed with and access to data provided to CNOOC, CNPC, SINOPEC, Shell, Total, SOCAR, JOGMEC, Petrovietnam, SOVICO Group, and Caspian Explorer. KMG operates a virtual data room providing access to geological and technical data on KMG's prospective and existing assets for potential partners, where they can view historical data on prospective blocks and make decisions on strategic partnerships. On top of attracting investment, following data room sessions companies provide their views on prospective sites, and leading international and domestic experts share their experience and expertise.

The Company held an open tender to select a strategic partner for the Bolashak block with the subsoil contract expected to be obtained in 2024. The strategic partner finances 100% of the exploration stage.

Also, based on the analysis of historical geological and geophysical data and basin modelling, three new promising blocks were identified for inclusion in the National Acreage Management Programme for further consideration of obtaining subsoil use contracts.

In 2023, we continued to investigate the prospects of poorly explored sedimentary basins. Reconnaissance work was carried out in the North Turgai sedimentary basin to plan the parameters of field seismic surveys and associated costs. Based on the results, decisions will be made as to exploration plans for the poorly explored sedimentary basins.

Kalamkas‑Sea, Khazar, and Auezov are strategic subsoil blocks located 60 km from Aktau in Kazakhstan's part of the Caspian Sea (Article 43 of the Code on Subsoil). The blocks are included in the National Acreage Management Programme's list of territories of subsoil blocks for exploration and production or production of hydrocarbons for granting subsoil use to the national hydrocarbon company (Order of the Minister of Industry and Infrastructure Development No. 478 dated 28 June 2018). The blocks have a total area of 1,707.17 km.

The Kalamkas‑Sea, Khazar, and Auezov fields were discovered in 2002, 2007, and 2008 respectively. Productive horizons occur at a level of 1,500–2,000 m below the seabed.

Commercial production and reserves:

Commercial production of first oil from the Kalamkas‑Sea and Khazar fields is scheduled for 2028–2029. Total recoverable reserves are estimated at 48.5 mln tonnes of oil and 19 bln m3 of gas, with a production volume of about 4 mln tonnes / year (80 thous. bbl per day) and a production plateau of at least five years.

Project investments:

KMG estimates project investments at about USD 6.4 bln (class 4).

Work performed in 2023:

Kalamkas‑Khazar Operating (“KKO”) was established for the purposes of KMG's project (7 February 2023).

Project agreements (Sale and Purchase Agreement, Parties' Agreement, Financing Agreement) were signed in connection with LUKOIL's entry into the project (9 February 2023).

A 45‑year Production Contract was signed between Kazakhstan’s Ministry of Energy and KMG (27 February 2023).

KMG and KKO signed an Agreement on Assignment (Transfer) of 100% of subsoil use rights under the Production Contract (30 March 2023).

Addendum No. 1 to the Production Contract was signed in connection with the transfer of subsoil use rights to KKO (subsoil user) (11 April 2023).

Following public consultations, a positive opinion was received from the Environmental Department on the impact assessments for the Field Development Project and the Technical Project for Engineering and Geological Surveys (19 July 2023).

Procedures were completed with respect to the sale of 50% of interest in KKO to LUKOIL (KMG Board of Directors Minutes No. 16/2023 dated 26 July 2023).

A constituent meeting of the General Meeting of Members No. 1 was held with the participation of the new member, LUKOIL (4 September 2023).

KKO was reincorporated, with its members being KMG (50%) and LUKOIL (50%) (11 September 2023).

The Field Development Project (FDP) was approved by the Central Commission for Exploration and Development of Mineral Reserves of Kazakhstan (Minutes No. 43/11 dated 29 September 2023).

Approval was received from KMG’s Investment Committee to move from Phase 2 (Pre‑FEED Concept Selection) to Phase 3 (Definition) and Phase 3 budget (10 November 2023).

KKO’s Supervisory Board approved the structure, budget for 2024, and a number of project agreements and documents (secondment agreements between KMG, KKO, and LUKOIL, remuneration rules, salary grid for employees, limits on business trips) (4 December 2023).

Work in progress:

With the aim of accelerating the project completion, work was being carried out within KKO’s budget during 2023 ahead of schedule (as approved by the Steering Committee of KMG and LUKOIL), including:

- offshore and onshore engineering and geological surveys;

- production and environmental monitoring;

- reprocessing of 3D seismic data interpretations.

The project is now at the Design stage.

Plans for 2024:

As part of Phase 3 and following the contractor selection, it is planned to implement the FEED Engineering to be completed by the end of 2024.

The final investment decision (FID) on the Project is expected in 2025.

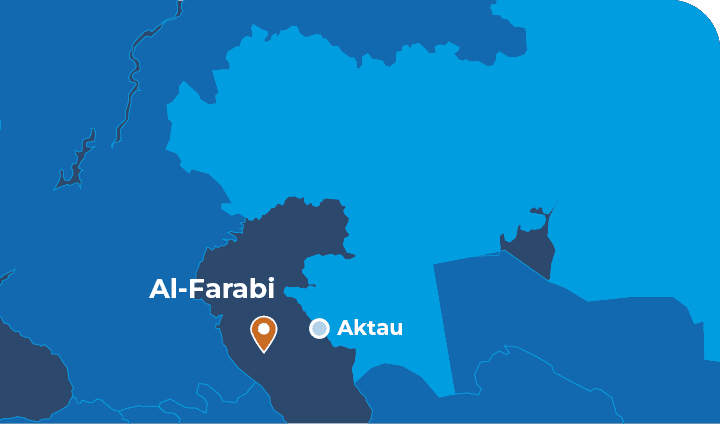

Subsoil user under the contract is Al‑Farabi Operating with the following ownership structure:

- KMG – 50.01% in the authorised capital of Al‑Farabi Operating;

- LUKOIL – 49.99% in the authorised capital of Al‑Farabi Operating.

During the period stretching from the commencement of exploration until approval of the field development project, the funding is provided by LUKOIL covering 100% of project costs on the basis of carry‑financing under the Financing Agreement dated 11 November 2021 between KMG and LUKOIL.

Project participants:

- KMG – 50% of subsoil use rights;

- Kokel Munay – 50% of subsoil use rights.

The project operator is Bekturly Energy Operating.

During the period of exploration, the funding is provided by Kokel Munay covering 100% of project costs on the basis of carry‑financing.

Appraisal of a discovered hydrocarbon field is currently underway.

Project participants:

- KMG – 50% of subsoil use rights ;

- Eni Isatay – 50% of subsoil use rights.

The project operator is Isatay Operating Company.

During the period stretching from the commencement of exploration until approval of the field development project, the funding is provided by Eni Isatay covering 100% of project costs on the basis of carry‑financing under the Financing Agreement between KMG and Eni Isatay.

Preparations are currently underway for the construction of a prospecting well.

Project participants:

- KMG – 100%.

The Turgai Palaeozoic project is implemented by KMG on its own and at its own expense.

Preparations are currently underway for the construction of a prospecting well.

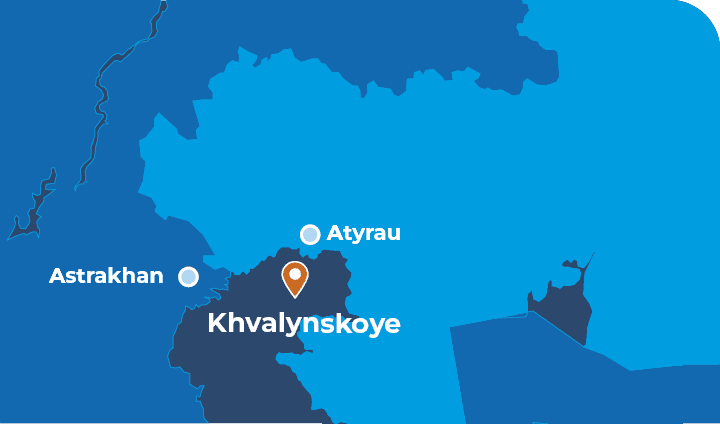

In 2005, authorised entities from Kazakhstan and Russia, KMG and LUKOIL respectively, established a 50/50 joint venture, Caspian Oil and Gas Company, which will be the authorised subsoil user under the Khvalynskoye project once the Production Sharing Agreement (PSA) is executed.

- LUKOIL‑Nizhnevolzhskneft is the licence holder until the PSA is executed.

The project funding is provided by KMG and LUKOIL in the form of loans at an interest on a parity basis.

Project participants:

- KMG – 50%.

- Tsentrcaspneftegaz (a 50/50 joint venture of LUKOIL and Gazprom) – 50%.

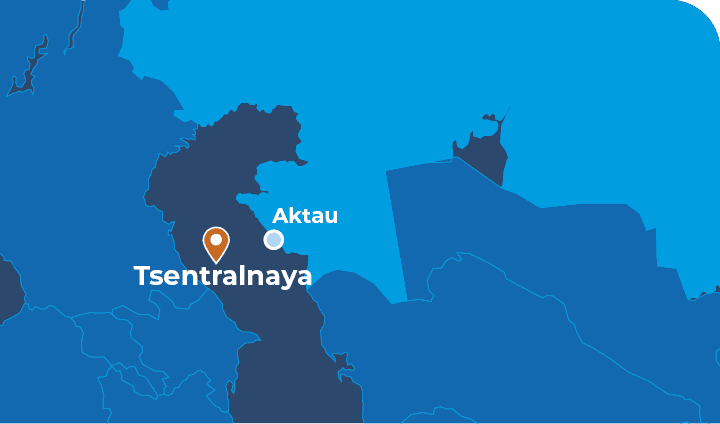

The operator and subsoil user is Tsentralnaya Oil and Gas Company incorporated in the Russian Federation.

During the period of exploration, the funding is provided by Tsentrcaspneftegaz covering 100% of project costs on the basis of carry‑financing.

Five subsoil exploration licences are held by KMG Barlau (KMG’s 100% subsidiary).

- Implementation period: 2022–2025.

- The project funding is provided by KMG at its own expense.

To date, field seismic surveying has been completed at four blocks, and processing/interpretation of the acquired data is underway.

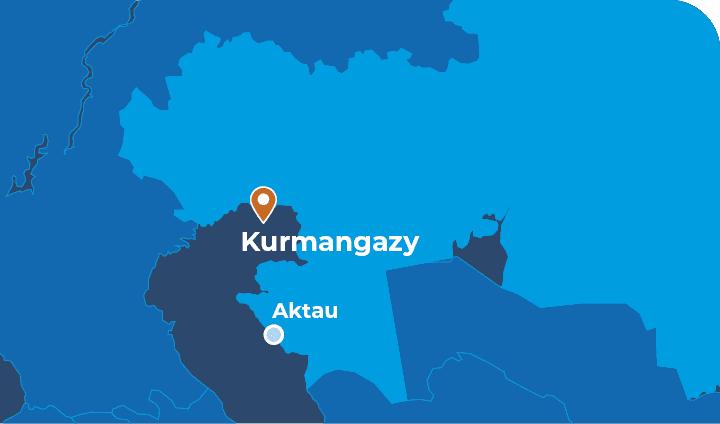

Project participants:

- KazMunayTeniz – 50% share in the PSA;

- RN‑Exploration (wholly‑owned subsidiary of Rosneft) – 50% share in the PSA.

The project operator is Kurmangazy Petroleum, a wholly‑owned subsidiary of KMG.

The project funding is provided by KMG and RN‑Exploration on a parity basis – 50% of costs each.

Karaton Operating (KMG’s 100% subsidiary) is the subsoil user under the contract.

- Karaton Operating (KMG’s 100% subsidiary) is the subsoil user under the contract.

- On 21 February 2024, Tatneft (Republic of Tatarstan, Russian Federation) officially acquired 50% in Karaton Operating.

The production is scheduled to start in 2028 and is forecast at 2.5 mln tonnes per year.

During the period stretching from the commencement of exploration until approval of the field development project, the funding will be provided by Tatneft covering 100% of project costs on the basis of carry‑financing.

Achievements in five years

- In 2019–2023, about KZT 178.5 bln was invested in exploration, including KMG’s costs of around KZT 89.5 bln. During this period, the West Karasor and Bekturly Vostochny fields were discovered. Based on the outcome of high‑resolution 3D seismic survey and drilling and testing of a prospecting well in the Bekturly Vostochny block, the prospects of non‑structural traps were proved.

- In 2019, an extensive high‑resolution 3D seismic survey was carried out at Taisoigan‑1 and Taisoigan‑2 blocks, resulting in the identification of 26 prospects with total potential geological resources of 328 mln tonnes (P50). In 2022, exploration and production contracts were obtained and transferred to Embamunaigas to continue exploration.

- New subsoil use contracts were signed for the Al‑Farabi, Karaton Subsalt, Kalamkas‑Sea / Khazar / Auezov blocks together with strategic partners. Exploration activities are carried out using carry financing provided by a strategic partner.

- A subsoil use contract was concluded for the Turgai Palaeozoic block in the Kyzylorda Region. Drilling of a 5,500 m prospecting well is scheduled for 2024.

- We achieved an impressive growth of oil reserves at the Uzen (+39.9 mln tonnes) and Kalamkas fields (+32.6 mln tonnes). Re‑appraisal of the fields’ reserves resulted from comprehensive efforts, including high‑resolution 3D seismic surveys, adjustment of the fields’ geological concept, drilling of new wells, laboratory analysis of core samples and re‑interpretation of geophysical well logs for the entire well stock.

- A subsoil exploration project was initiated with respect to five prospective blocks in the Aktobe, Mangistau, West Kazakhstan, and Atyrau regions. 2D and 3D regional field seismic surveys were carried out in 2023, with data processing and interpretation underway. Following their completion, decisions will be made whether to obtain subsoil use contracts for detailed exploration.

- The total organic growth in recoverable oil reserves in 2019–2023 attributable to KMG was 115 mln tonnes (A+B+C1) under the system of Kazakhstan’s State Commission on Mineral Reserves.

Sanctions risks of Russian partners

The sanctions imposed on Russian companies and banks narrow down the range of contractors which provide services in the Caspian Sea, and therefore increase the cost of work. Thus, we conducted an analysis of the potential use of suppliers and service companies that are not subject to sanctions. We continue to gather information. KMG also included clauses stipulating withdrawal from projects and joint ventures, if US, EU, and UK sanctions are imposed on Russian partners, in the documents on joint activities with them.

Deploying new technologies, optimising exploration, and improving performance

In 2023, for the first time in its history, KMG conducted pilot seismic operations using unique arrangement of field equipment to study the subsurface geology of the Caspian sedimentary basin, covering depths of up to 20 km.

In 2024, the Company plans to test wireless sensor technology in seismic surveys for further roll‑out in areas planned for subsoil exploration. This technology optimises the timing of seismic surveys and covers large areas with seismic exploration.

Also in 2024, we plan to test pulse source technology for seismic surveying in environmentally sensitive transit areas of the Caspian Sea. This technology minimises environmental impact and acquires cutoff‑grade seismic data in the transit areas in an eco‑friendly manner.

Improved model contract

In 2023, to improve competitiveness and attract additional investment in geological exploration of complex projects, as well as replenish hydrocarbon reserves, as instructed by the President of the Republic of Kazakhstan, the Government drafted amendments and modifications to relevant legislative acts (Code on Subsoil and Subsoil Use and Code on Taxes and Other Mandatory Payments to the National Budget, and other laws), providing for the introduction of a new mechanism – the improved model contract.

The resulting package of amendments related to the improved model contract includes a number of regulatory and fiscal preferences that help increase the profitability of exploration in complex projects:

- with high hydrogen sulphide concentration (3.5% or more);

- subsalt deposits with a salt thickness of at least 100 m;

- non‑structural traps and deep deposits with the top at depths below 4,500 m;

- deposits with abnormally high reservoir pressures (anomaly ratio of 1.5 or more);

- new offshore projects (all exploration blocks or fields in Kazakhstan’s part of the Caspian Sea and the Aral Sea);

- gas projects (gas or gas condensate fields where the share of oil saturated part of reservoirs is less than 0.25 in the total volume of hydrocarbons of all deposits of the field).

Thanks to improved model contract preferences, it became possible to obtain subsoil use contracts for the Kalamkas‑Sea / Khazar / Auezov and Karaton Subsalt blocks on more favourable terms. Subsequently, it will be possible to explore and develop more complex projects with reliance on preferences of improved model contracts and better project economics.